DOI:

https://doi.org/10.14483/22487638.9169Publicado:

01-07-2018Número:

Vol. 22 Núm. 57 (2018): Julio - SeptiembreSección:

InvestigaciónPlaneación de capacidades operativas asociadas a la rentabilidad en empresas prestadoras de servicios. Un enfoque de dinámica de sistemas

Operational planning capacities associated with profitability of service companies. A system dynamics approach

Palabras clave:

capacity planning, financial model, profitability, system dynamics (en).Palabras clave:

planeación de capacidad, modelo financiero, rentabilidad, dinámica de sistemas (es).Descargas

Cómo citar

APA

ACM

ACS

ABNT

Chicago

Harvard

IEEE

MLA

Turabian

Vancouver

Descargar cita

Recibido: 23 de agosto de 2017; Aceptado: 23 de marzo de 2018

Abstract

Context:

Capacity planning is one of the critical elements in business decisions at any level since it is possible to respond to the fluctuating needs of the market through its correct configuration and allocation. As in most decisions in the field of Industrial Engineering, in the processes of planning and programming of the capacity of the productive systems, there are some aspects that cannot be left aside: the costs related to each configuration, the relationship between the variables of allocation of resources, and the response to the requirements of the clients; these constitute the basis of the models applied in the processes related to the capacities in the organizational systems.

Method:

A model was developed using systems dynamics, which allows to determine the number of personnel to respond to changes in demand; the best use of the capacity of the resources assigned to the service provision was sought according to the profitability of the business unit; and the behavior of the demand for services was simulated based on historical data on the behavior of the system.

Results:

The proposed model allows to identify the capacities, and their respective calculations, involved in the modeling. In addition, it is possible to contrast the behavior of the model (which seeks to maximize the use of available capacity by seeking the best configuration in the allocation of resources) without neglecting the profitability of the operation. This is of interest for the planning of the system, considering the costs associated with the underutilization of the work force or the insufficient provision of the service to the client.

Conclusions:

The model presented in this research is a proposal for the analysis of operational capacities in service providers that have several variables to consider, such as the use of human resources, the demand for diverse services attended by specialized personnel, different work days, and the use of specific facilities. The search for the best configuration of the resources involved in this service provision allows companies to continually inquire about obtaining better rates of use and profitability.

Keywords:

capacity planning, financial model, profitability, system dynamics.Resumen

Contexto:

La planeación de capacidades constituye uno de los elementos críticos en las decisiones empresariales a cualquier nivel ya que por medio de su correcta configuración y asignación se logra responder a las necesidades fluctuantes del mercado. En los procesos de planeación y programación de la capacidad de los sistemas productivos, como en la mayoría de las decisiones en el campo de ingeniería industrial, no se pueden dejar a un lado los costos relacionados con una configuración u otra, la relación entre las variables de asignación de recursos y la respuesta a los requerimientos de los clientes, que constituyen el fundamento de los modelos aplicados en los procesos relacionados con las capacidades en los sistemas organizacionales.

Método:

Se elaboró un modelo empleando una dinámica de sistemas, la cual permite determinar la cantidad de personal que responde a los cambios en la demanda. Se buscó la mejor utilización de la capacidad de los recursos asignados a la prestación del servicio según la rentabilidad de la unidad de negocio. A partir de datos históricos del comportamiento del sistema, se simuló el comportamiento de la demanda de servicios.

Resultados:

El modelo planteado permite identificar las capacidades involucradas y su cálculo en el modelamiento; además, se logra contrastar el comportamiento del modelo, el cual, mediante la búsqueda de la mejor configuración en la asignación de recursos, persigue el objetivo de maximizar la utilización de la capacidad disponible, sin dejar de lado la rentabilidad de la operación. Lo que resulta de interés para la planeación del sistema, dados los costos asociados a la subutilización de la fuerza de trabajo o la prestación insuficiente del servicio al cliente.

Conclusiones:

El modelo se establece como una propuesta para el análisis de capacidades operativas en empresas prestadoras de servicios que contemplen recurso humano para su ejecución, en donde se presente una demanda de servicios de diversos tipos para ser atendida por personal especializado, en diferentes jornadas de trabajo y mediante el uso de instalaciones específicas. La búsqueda de la mejor configuración de los recursos involucrados en dicha prestación de servicio permite a las empresas de este sector la continua indagación sobre la obtención de mejores índices de utilización y rentabilidad.

Palabras clave:

planeación de capacidad, modelo financiero, rentabilidad, dinámica de sistemas.INTRODUCTION

A service is defined as a set of activities that satisfy a particular need and is characterized by a high level of intangibility, which requires management before and after the process in order to achieve complete satisfaction from the customer. This section will show the international and national panorama of the sector of service provision.

Services have an important repercussion on growth and efficiency in many industries and in general economic results. Presently, they represent more than two thirds of the global gross domestic product (GDP), and the added value of services in the GDP tends to significantly increase with the income level of a country (World Trade Organization, 2010).

Financial services cover financial intermediation activities and auxiliary services provided by banks, stock markets, factoring companies, credit card companies, etc., and include financial intermediation services that are measured indirectly. Importation of this type of service due to technological advances in this sector is representative; however, exports of this type of service in the national field have been steady.

This study addresses the problem of profitability as a determining factor in assigning resources in order to identify performance in planning capacity. Additionally, we seek to study the impact of financial results in the provision of a service with respect to the allocation of capacities for such service provision, by looking for the best configuration that guarantees a good result in terms of service levels and labor cost that respond to fluctuations in demand. The article is structured into four chapters: The first presents a review of literature that focuses on the dynamics of publications and the taxonomy of models related to capacity and profitability from a systems dynamics approach. The second chapter presents the method used and its relation to the conceptual model used. The third chapter shows the model using the methodology proposed by Forrester (Forrester, 1961). And the chapter 4 presents the results, the discussion, and the conclusions.

Review of Literature

The System Dynamics methodology allows the performance of highly complex systems to be modeled. The interaction of profitability used in decision making according to capacity allows a company to optimize the use of resources to provide the service. One of the reasons to use the System Dynamics methodology is that the service systems contemplate various scenarios and players that interrelate in a complex and unpredictable way; therefore, if the performance of this system is understood, the objectives of the system can be simulated through archetypes.

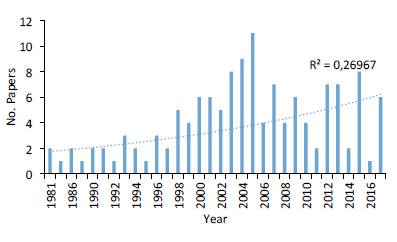

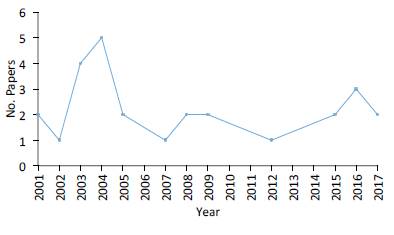

The dynamics of the publication of articles presented at the International Conference of the System Dynamics Society is shown in figure 1. An exponential performance of publications is shown in aspects associated with service capacity and profitability. It also identifies an increase in the number of publications from 1981 to 2017. From 2004 the number of publications diminishes but stays constant, reflecting the validity of the subject addressed by various authors.

Figure 1: Dynamics of publications at the international conference of the system dynamics society in capacity and profitability

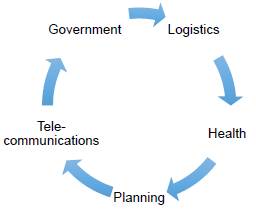

The different models presented by the authors in System Dynamics can be categorized using five publication approaches: Applied to governmental politics, logistics, health, planning and telecommunications. As shown in figure 2.

Figure 2: Taxonomy of model classification related to Capacity and profitability

On the other hand, the evolution of publications related to the capacity of addressing a system using the System Dynamics Methodology is presented in figure 3. In referring to profitability models using the System Dynamics approach, the dynamics of publications diminishes starting in 2004; however, it continues to have a minimum amount until 2012. This is due to the fact that profitability models are approached from a financial perspective that does not contemplate the complexity of assignment relationships in capacities that a system comes to have. For that reason, this study provides information that shows the need to integrate profitability concept with system capacity.

Figure 3: Dynamics of publications of profitability models using the system dynamics approach

Models of capacities applied to logistics The models addressed using the System Dynamics Methodology include an analysis of capacity levels in the design and management of the supply chain, which analyze capacity restrictions through several combinations of levels in the supply chain (Evans, 1994).

On the other hand, the performance of services in the supply chain is addressed using the System Dynamics Methodology, due to the changes in demand and its relationship to inventory levels, the information in the supply chain, the deficit, and the physical capacity of product manufacturing (Douglas, 2005; Gonçalves Hines & Sterman, 2005). In this sense, the methodology using the System Dynamics has been widely used to address logistic problems in the supply chain (Zilouchian, Cardenas Martinez, Koochak-Yazdi, & Murad, 2012), (Tiru, Yuhua, & Anson, 2012), (Shamsuddoha, Quaddus, & Klass, 2013) y (Hettesheimer & Lerch, 2013).

The planning of resources through a logistics operator has been considered from the modeling of System Dynamics, and it considers financial performance, among other aspects (Romero Quiroga & Becerra Fernández, 2017).

Models applied to planning

An analysis of human resources assignments in bank service activities, which provides new structures when compared to classical assignment techniques generated by the Operations Investigation, is done (Becerra Fernandez, 2013).

Orjuela and Huertas (Orjuela & Huertas, 2004) characterize the capacities of companies of services provision, from their evolution, and compare them with the capacities available to the manufacturing sector. Mejia, Hincapie y Gallego (Mejia So-lanilla, Hincapié Isaza, & Gallego Rendón, 2015) propose a model applied to the energy sector for distribution planning through a multi-objective analysis, associated with financial measures, such as the cost of operation and investment.

Other models analyze attention capacities using perception parameters regarding the length of lines (Delgado, 2011), (Ann van Ackere, 2006). System Dynamics analyses contemplate models that use human capital and planning analysis to model service dynamics, in order to present models that evaluate public policies in Australia (Sveiby, 2002).

Models that analyze services and impacts on quality to determine service management policies are approached through System Dynamics using empirical tests that determine service quality (Senge, 1993).

Additionally, the design and planning of the supply chains for the reduction of logistic costs is approached from a multiple selection objective programming model to find a favorite solution (Aalaei & Davoudpour, 2016).

METHODS

The conceptual structure of the model that was developed was based on the study of effects that are generated in the dynamics of the financial services sector and activities associated with the generation of profitability in providing services. The construction of the conceptual structure requires formulating the problem and the underlying dynamic hypothesis as an axis of a causal diagram and the creation of structure simulation sectors. Then, aspects inherent to the conceptual structure and analysis of the model with system dynamics are developed.

Methodology proposed by (Morecroft & Sterman, 1994) and (Forrester, 1961) was used to develop the capacity planning model, which was done using the ITHINK computer program.

Model

The model used analyzes the performance of resource capacity planning using the profitability modeling of a financial services company, and the problem and the hypothesis used were formulated. Then the problem addressed was approached using the system dynamics methodology.

Formulating the problem

The growth of an organization requires a change in procedures and processes that requires looking at the impact of quality and food safety in fruit products. Therefore, the problem formulated is: What is the capacity performance due to changes in the profitability of companies that provide financial services?

In this way, the following dynamic hypothesis that supports the developed model was proposed.

Dynamic hypothesis

Capacity planning of resources used by financial services companies depend on the profits obtained during certain periods.

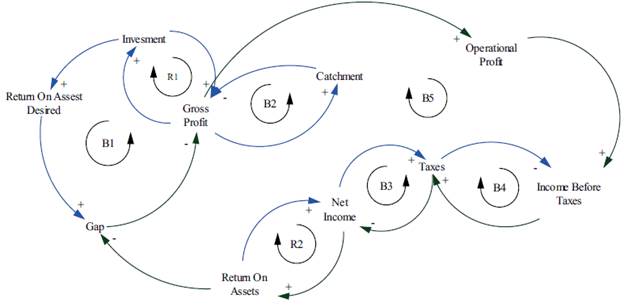

Causal diagram

The causal diagram of the model for resource capacity planning by means of dynamic analysis of profitability approaches the conceptual elements of experts in the financial sector and theories that have looked at the subject using different approaches and simulation structures. The causal diagram proposed has five balancing loops and two reinforcing loops. In this case, the reinforcing loops represent the effect of the net income and profitability. The balancing loops are related to the effect of taxes on profitability of the financial services companies (figure 4).

Figure 4: Causal diagram of the capacity and profitability planning model

The simulation structure, developed using the System Dynamic methodology, is presented as follows.

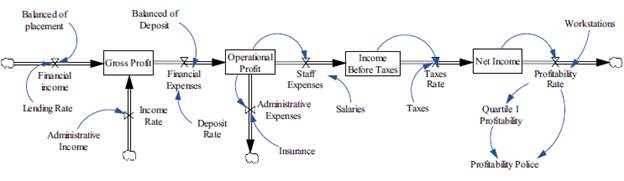

Simulation structure

The structure of the profitability sector is shown in levels: Gross Profit, operational profit, profit before taxes, and profit after taxes. Figure 5 represents the Forrester diagram in the profitability sector. This contemplates income calculated from profitability and placement time used as a point for decision making.

Figure 5: Profitability sector forrester diagram

Profitability is analyzed using this structure, keeping in mind the placement time of financial income, and different rates that intervene in profitability flows.

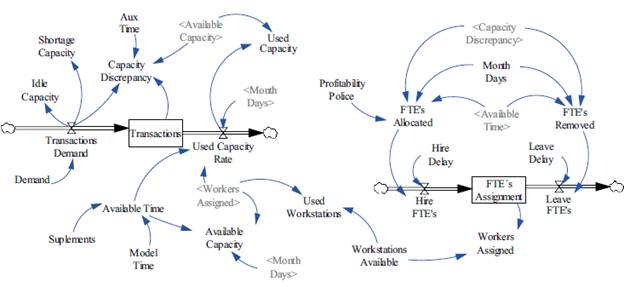

On the other hand, the capacity planning structure was designed according to different workdays in a financial services company (daytime, additional hours, and Saturdays), and service levels (cashiers and representatives). Figure 6 presents a Forrester model designed to analyze performance in assigned work positions according to transactions and available capacity.

Figure 6: Forrester diagram capacity planning sector

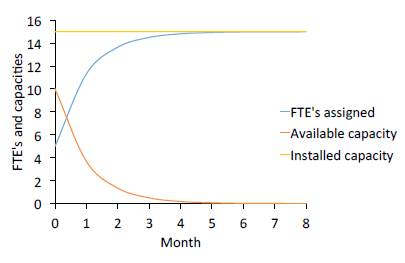

The combination of the two sectors allows the analysis of the performance of resource capacity planning from the profitability of financial service companies. The calibration of the model mainly consisted in analyzing the behavior of the allocation of personnel against the installed capacity and the available capacity of the system, which means that the appropriate assignment is made according to the capacity of the system (see figure 7).

Figure 7: Calibration of the model

The following section presents the simulation results obtained from the structures of the sector.

RESULTS AND DISCUSSION

Capacity and profitability planning

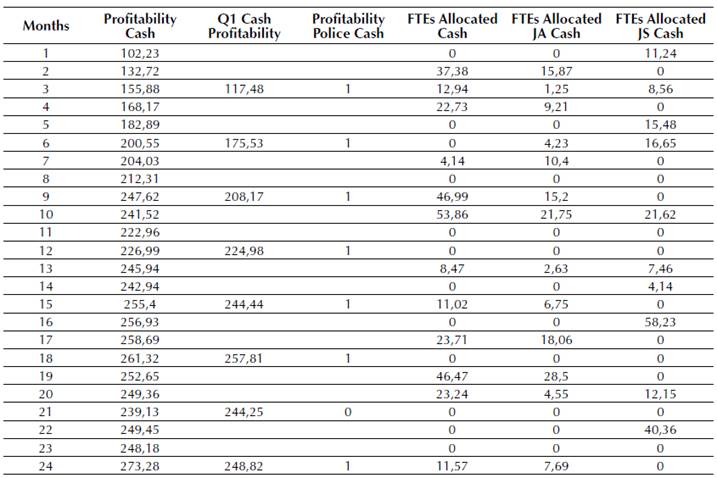

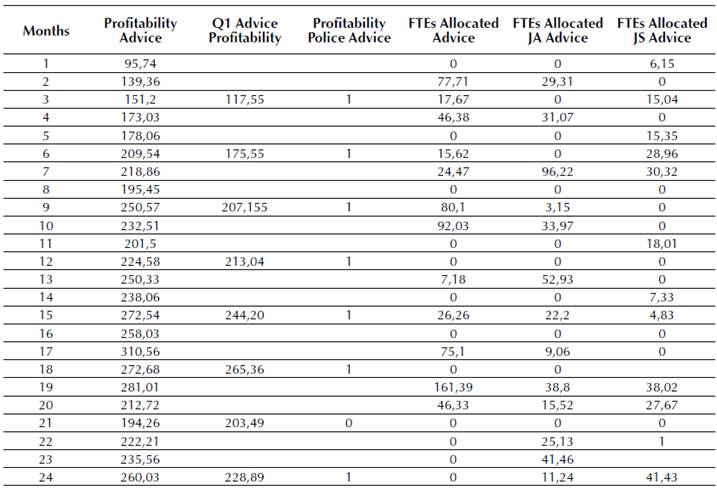

The capacity planning model shows the assignment performance over time of representatives and cashiers in a financial services company. Performance fluctuations are shown in Table 1, where higher assignment values for representatives in daytime work (DW) and a lesser value in the assignment for Saturday work (SW) stand out. Capacity planning performance maintains a similar pattern in the first 12 months to that of profitability performance, as shown in table 1 and table 2.

Source: own work

Table 1: Profitability performance in the capacity planning model to cash

Source: own work

Table 2: Profitability performance in the capacity planning model to advice

On the other hand, profitability diminishes as the number of representatives assigned increases each day. Therefore, Table 1 and 2 show that profitability limits the assignment of representatives and/or cashiers in a financial services company.

Profitability performance in the capacity planning model can analyze changes in placement time and in the influence of assets rates in income; these this in turn change the assignment of personnel (representatives or cashiers). With a higher placement time the profitability grows slower, which affects in the assignment of resources. Conversely, with a lesser time the system presents a better performance in reference to assignment of resources.

CONCLUSIONS

In a capacity planning process, the fluctuating restrictions of the system affect the assignment of resources. This means that less profitability results in lower resource assignment; thus, optimizing the resource using other analysis techniques will not allow the absorption of fluctuations associated with placement times of assets and profitability in financial services companies. The application of system dynamics methodology to address complexity models allow the capacities' performance and fluctuation over time to be analyzed. The analysis of financial aspects linked to capacity allows the integral contextualizing of the performance of a financial services company system.

FUTURE STUDIES

By means of this model, analysis of planning capacity performance is done while keeping in mind the profitability restriction in several service sectors. Also, it can include other aspects that restrict the assignment of personnel in service companies, such as technologies used, processing resources available and factors involving service quality.

REFERENCES

APPENDIX

The main equations of the model are presented as follows:

Gross_profit(t) = Gross_profit(t-dt) + (Financial_in-come + Income_rate-Financial_expenses) * dt

-

INIT Gross_profit = 65178

-

INFLOWS:

-

Financial_income = ((((1+Lending_rate)

(30/365))-1)*Balanced_of_palcement)

(30/365))-1)*Balanced_of_palcement) -

Income_rate = Administrative_income

-

OUTFLOWS:

-

Financial_expenses = (((1+Deposit_rate)A (30/365))-1)*Saldo_Captación

Income_before_taxes(t) = Income_before_taxes(t-dt) + (Staff_expenses-taxes_rate) * dt

-

INIT Income_before_taxes = 32494.82

-

INFLOWS:

-

Staff_expenses = Opertional_profit*Salaries_rate

-

OUTFLOWS:

-

taxes_rate = Income_before_taxes-(Income_be-fore_taxes*Taxes)

Net_income(t) = Net_income(t-dt) + (taxes_rate-Profitability) * dt

-

INIT Net_income = 21771.53

-

INFLOWS:

-

taxes_rate = Income_before_taxes-(Income_be-fore_taxes*Taxes)

-

OUTFLOWS:

-

Profitability = Net_income/Workstation

Opertional_profit(t) = Opertional_profit(t-dt) + (Financial_expenses-Staff_expenses-Administrative_ expenses) * dt

-

INIT Opertional_profit = 61350.38

-

INFLOWS:

-

Financial_expenses = (((1+Deposit_ra-te)A(30/365))-1)*Saldo_Captación

-

OUTFLOWS:

-

Staff_expenses = Opertional_profit*Salaries_rate Administrative_expenses = Opertional_profit* Insurance_rate

Administrative_income = NORMAL(23.76, 8.48) Balanced_of_palcement = NORMAL(6257.27, 2844.28)

Deposit_rate = NORMAL(0.0359, 0.0009) Insurance_rate = 0.08

Lending_rate = NORMAL(0.1422, 0.001907) Salaries_rate = 0.04

Saldo_Captación = NORMAL(4992.84, 2149) Taxes = 0.33

Licencia

Esta licencia permite a otros remezclar, adaptar y desarrollar su trabajo incluso con fines comerciales, siempre que le den crédito y concedan licencias para sus nuevas creaciones bajo los mismos términos. Esta licencia a menudo se compara con las licencias de software libre y de código abierto “copyleft”. Todos los trabajos nuevos basados en el tuyo tendrán la misma licencia, por lo que cualquier derivado también permitirá el uso comercial. Esta es la licencia utilizada por Wikipedia y se recomienda para materiales que se beneficiarían al incorporar contenido de Wikipedia y proyectos con licencias similares.