DOI:

https://doi.org/10.14483/22487638.16194Publicado:

01-10-2020Número:

Vol. 24 Núm. 66 (2020): Octubre - DiciembreSección:

ReflexiónAnalysis of the impact of the construction sector on Colombian economy

Análisis del impacto del sector de la construcción en la economía colombiana

Palabras clave:

construcción, economía colombiana, sector de la construcción, vivienda de interés social (es).Palabras clave:

Colombian economy, construction, construction sector, social interest housing (en).Descargas

Referencias

Alcaldía Mayor de Bogotá. (2017). Estudio económico del sector de la construcción, proyectos de conservación y/o construcción de infraestructura vial y de espacio público (Instituto de Desarrollo Urbano, ed.). Bogotá, Colombia.

Asociación Nacional de Empresarios de Colombia-ANDI. (2019). Colombia: Balance 2018 y Perspectivas 2019 Tabla de contenido. Bogotá, Colombia.

Cámara Colombiana de la Construcción-CAMACOL. (2019a). Economía en la mira. Bogotá D.C.

Cámara Colombiana de la Construcción-CAMACOL. (2019b). Prospectiva Edificadora, Una visión de corto y mediano plazo (Tercera Ed). Bogotá D.C.

Cámara de Comercio de la Construcción-CAMACOL. (2019c). Balance del primer trimestre de 2019, un mercado a la espera de señales de recuperación. Bogotá D.C.

Congreso de la República de Colombia. (2019). Ley 1955 de 2019, Por el cual se expide el Plan Nacional de Desarrollo 2018-2022. Bogotá D.C.

Córdova, J., & Alberto, C. (2018). Medición de la eficiencia en la industria de la construcción y su relación con el capital de trabajo. Revista Ingeniería de Construcción, 33(1), 69-82. https://doi.org/10.4067/S0718-50732018000100069

Corficolombiana. (2019). Perspectivas Económicas Corficolombiana Proyecciones 2020: Contra La Corriente ¿Hasta cuándo?. Bogotá D.C.

Corficolombiana. (2019a). Informe semanal, Rompiendo barreras. Bogotá D.C.

Corficolombiana. (2019b). Servido al carbón. Bogotá D.C.

Departamento Administrativo Nacional de Estadística–DANE. (2012). Clasificación Industrial Internacional Uniforme de todas las Actividades Económicas. Bogotá D.C. Obtained from https://www.dane.gov.co/files/nomenclaturas/CIIU_Rev4ac.pdf

Departamento Administrativo Nacional de Estadística-DANE. (2019a). Boletín Técnico Índice de Costos de la Construcción de Vivienda - ICCV, Bogotá D.C. Obtained from http://www.dane.gov.co/files/investigaciones/boletines/iccv/pres_iccv_jun16.pdf

Departamento Administrativo Nacional de Estadística-DANE. (2019b). Producto Interno Bruto desde un enfoque de producción. Bogotá D.C. Obtained from www.bcn.gob.ni/estadisticas/sector_real/produccion/1-3.xls

Departamento Administrativo Nacional de Estadística (DANE). (2019c). Indicadores Económicos Alrededor de la Construcción (IEAC) - Primer trimestre. Bogotá D.C.

Departamento de Estudios Económicos y Técnicos (2017). Tendencias de la construcción, Economía y coyuntura sectorial. Bogotá D.C.

Erkens, D. H., Hung, M., & Matos, P. (2012). Corporate governance in the 2007-2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance, 18(2), 389-411. https://doi.org/10.1016/j.jcorpfin.2012.01.005

Fondo Monetario Internacional-FMI. (2018). Perspectivas de la economía mundial al día. Davos, Suiza.

Fondo Monetario Internacional-FMI. (2019). Fiscal Monitor, Curbing corruption. Washington D.C.

Global Construction Perspectives and Oxford Economics. (2015). Global construction market to grow $ 8 trillion by 2030: driven by China, US and India.

Hatzius, J., Phillips, A., Mericle, D., Hill, S., Struyven, D., Chen, B., & Walker, R. (2018). Outlook: The Home Stretch. Goldman Sachs US Economics Analyst, 1-15.

International Monetary Fund. (2009). World economic outlook: A survey by the staff of the international monetary fund Occasional (27). https://doi.org/10.1016/0164-0704(84)90151-4

Kamenetskii, M. I. (2013). Construction sector as a factor of prospective development of the national economy. Studies on Russian Economic Development, 24(3), 249-258. https://doi.org/10.1134/S1075700713030052

Mehdian, S., Rezvanian, R., & Stoica, O. (2019). The Effect of the 2008 Global Financial Crisis on the Efficiency of Large U.S. Commercial Banks. Review of Economic and Business Studies, 12(2), 11-27. https://doi.org/10.1515/rebs-2019-0089

Mesa C, R. J., Constanza, R. Od., & Aguirre B, Y. C. (2008). Crisis externa y desaceleración de la economía colombiana en 2008-2009: coyuntura y perspectivas. Perfil de Coyuntura Económica, (12), 31-67.

Ortiz, C., Jiménez, D., & Cruz, G. (2019). El impacto de la infraestructura en el crecimiento económico colombiano: un enfoque smithiano. Lecturas de Economía, 90(90), 97-126. https://doi.org/10.17533/udea.le.n90a04

Project Management Institute. (2017). Guía de los fundamentos para la dirección de proyectos (Guía del PMBOK®) (Project Ma; I. Project Management Institute, Ed.).

World Bank Group. (2019a). Global Economic Prospects, June 2019: Heightened Tensions, Subdued Investment. https://doi.org/10.1596/978-1-4648-1398-6

World Bank Group. (2019b). Lao PDR Economic Monitor, Maintaining economic stability, August 2019. In World Bank Group (Ed.), Lao PDR Economic Monitor, January 2019. https://doi.org/10.1596/31243

Cómo citar

APA

ACM

ACS

ABNT

Chicago

Harvard

IEEE

MLA

Turabian

Vancouver

Descargar cita

Recibido: 23 de enero de 2020; Aceptado: 13 de agosto de 2020

Abstract

Objective:

Construction is one of the fastest growing and most important economic sectors worldwide, mainly due to its impact on job creation, trade in materials and the creation of essential infrastructure for social development. However, the behavior of the global market has recently been immersed in an environment of economic and political uncertainty, causing trade and industrial production to show signs of vulnerability. Despite the unfortunate ones established in the global economy, there will be moderate growth in rankings of developing countries like Colombia in different sectors.

Methodology:

This research focuses on analyzing the construction sector. The analysis is carried out from its historical impact on Colombian economic development and its relationship with external phenomena, to the evaluation of macroeconomic indicators (supply and demand), infrastructure, and job creation through the formulation of projects in this sector. In particular, these projects are differential for having a public investment effect in the construction of houses and civil works.

Results and Conclusions:

It was concluded that there is a weak recovery in the general market in relation to the factors surrounding the construction sector, allowing for a glimpse and focus on the trends and impact on the formulation of construction projects in the Colombian economy.

Financing:

Universidad EAN.

Keywords:

Colombian economy, construction, construction sector, social interest housing.Resumen

objetivo:

La construcción es uno de los sectores económicos de mayor crecimiento e importancia en a nivel mundial, principalmente por su impacto en la generación de empleo, el comercio de materiales y la creación de infraestructura esencial para el desarrollo social. Sin embargo, el comportamiento del mercado global recientemente ha estado inmerso en un ambiente de incertidumbre económica y política, ocasionando que el comercio y la producción industrial muestren signos de vulnerabilidad. A pesar de los desafortunados pronósticos en economía a nivel global, se prevé un crecimiento moderado en clasificaciones de países en vía de desarrollo como Colombia en diferentes sectores.

Metodología:

La investigación se enfocó en analizar el sector de la construcción partiendo de su incidencia histórica en el desarrollo económico colombiano y su relación con fenómenos externos, hasta la evaluación de indicadores macroeconómicos, la oferta y demanda en bienes de capital, la infraestructura y la generación de empleo mediante la formulación de proyectos en este sector, los cuales son diferenciales por tener un efecto de inversión pública en la construcción de vivienda y obras civiles.

Resultados y Conclusiones:

Se dedujo una débil recuperación del mercado general en relación con los factores alrededor del sector de la construcción, permitiendo vislumbrar y focalizar las tendencias e impacto en la formulación de proyectos de construcción en la economía colombiana.

Financiamiento:

Universidad EAN

Palabras clave:

construcción, economía colombiana, sector de la construcción, vivienda de interés social.INTRODUCTION

The global economy is currently in an environment of economic and political uncertainty, volubility in markets, and economic growth reduction. Besides, the upsurge of commercial tensions continue further that forecasted, and this includes the recent upscale between the main economies, a deceleration of the global investing, and the decline of trust and investment (FMI, 2018; World Bank Group, 2019a). These hardenings in financial conditions and the weakening of the fiscal stimulus are the main boosters of the deceleration in economic growth that upsurged in 2019, where commerce and the manufacturing industry showed signs of marked weakness (World Bank Group, 2019a).

Part of this growth has been maintained due to public investment according to forecasts, thus the construction and commerce sectors contribute to the increase of GDP; so, there were early signs of recovery in the first quarter of 2019 (Global Construction Perspectives and Oxford Economics, 2015; World Bank Group, 2019b). Therefore, the IMF (2019) foresees that developing countries of low income and several emerging market economies should create work opportunities and improve public infrastructure, such as the ones related to services that satisfy the needs of populations in fast expansion and urbanization. In consequence, the social expense and fiscal policies in every country should follow the rate of change of the working and product markets, which are caused by the technological advances and the deepening of commercial and financial links in order to adapt the policies to global trends, fomenting long-term economic growth, and co-helping the reestablishment of trust of the citizens towards institutions.

Part of the function of the construction sector is focused on meeting the needs of companies and citizens through buildings, structures, houses, and other new or renovated projects. This function is limited by the value of effective demand of said products and determined by the amount of investment in fixed assets assigned to this end, where the public sector invests capital according to social functions, and the private sector executes the construction previous to the formulation of the project. Therefore, national economics and financing altogether determine the volume of constructions that can be made, so investments play a major role in the evaluation of present and future. Therefore, the adaptating and focusing of projects contributes to the growth and development of the markets, and it highlights the most important aspects for the elaboration of a long-term prevision in the construction industry through the adoption of social objectives (Kamenetskii, 2013).

Over the last decade, the main part of the growth in construction came from emerging countries, while developed markets have not yet recovered their usual volumes previous to the crisis (ANDI, 2019; Hatzius et al., 2018). This paper evaluated the historical development of the Colombian economy, specially within the construction sector, its performance in the promoting of public infrastructure and its impact in the national economic development. Macroeconomic indicators were evaluated, as well as their incidence in the supply and demand of capital goods, and public investment in housing construction, allowing a glimpse of the trends and impact of the construction sector in the Colombian economy.

METHODOLOGY

The construction sector experiments sharper activity cycles than other branches of economic activity; it is also susceptible to international economic variations. Therefore, it is considered one of the main economic indicators given the influence it has on the variations of the economy cycle (DANE, 2019a). As a result, and in order to establish the effect of this sector in the Colombian economy, historical information from the government entities responsible for the analysis of global economic activities was used. The researched entities were mainly the National Statistical Administration Department (DANE, in Spanish) and the National Planning Department (DNP, in Spanish). Also, investigations and data previously processed by the Colombian Construction Chamber (CAMACOL, in Spanish) were incorporated.

Regarding the historical information properly depurated, the macroeconomic variations related to the supply and demand of construction of housing were analyzed, while aiming establish representative phenomena. The selected data is presented below:

-

Selection of the gross production in billions of Colombian pesos, separating the values related to importation taxes, nondeductible Value Added Tax (VAT), product taxes, grants for the product with original data published quarterly by the DANE over the last 15 years (2005-2020); here the accumulated production value of the last quarter was selected as representative. Likewise, the 12 initial activity groups according to the latest Classification of Economic Activities (DANE, 2012) were selected, as well as the subsectors that conform the construction sector.

-

Evaluation of the gross production of the construction sector and subsectors through the selection of data provided by the DANE with the classification of 25 economic activity groups in the country, according to Section CIIU Rev. 4 A.C, in billions of pesos. Annual variation rates were evaluated, taking values from the last quarter as the representative value and annual accumulated of the last fifteen years (2005-2020). Likewise, the evaluation of the residential building subsector was done through supply and demand of housing in square meters in the same lapse of fifteen years; price discrimination was taken according to the classification established in the development national plan (Law 1955 of 2019), differencing price ranks between Priority Interest Housing (VIP), social interest (VIS), and non-VIS.

-

Evaluation of employment through data collected in the big integrated home poll (GEIH, in Spanish), which supplies basic information related to the size of the work force of the country and is made monthly by the DANE. Data of population occupied in the construction sector was used, taking the annual average as representative value as well as annual variation rate.

The information collected was compared with external economic phenomena by analyzing recurring reports supplied by economic research centers; it was also compared with reports from private associations and several commerce chambers, especially CAMACOL, in order to relate the productivity of the construction sector and subsectors (and their employment generation) with various external and internal dynamics.

RESULTS

Development of the productivity of the Colombian economy

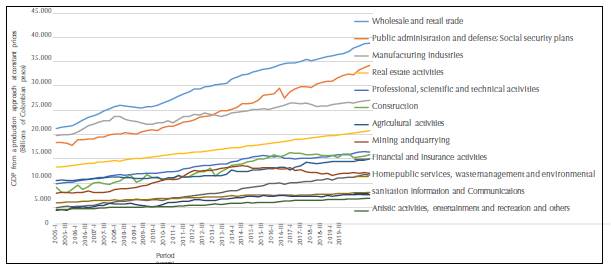

The GDP information analysis from a production approach (DANE, 2019b) measures billions of pesos in constant prices from the 12 main economic activity branches of the country in the last fifteen years and gives a global scenario of the performance of these sectors altogether with the impact of external phenomena and its incidence in the economy (Figure 1 )

Figure 1: GDP of the production of the main branches of the Colombian economy.

Figure 1 presents the GDP from a production approach. the activities are classified based on the fourth review of the CIIU in Colombia (DANE, 2012). Due to stational and calendar effects, it registers the historical evaluated and corrected production in billions of pesos at constant total production prices during the last fifteen years (2005-2019). Generally, all economic activities have grown at a constant rate in the last fifteen years, and the main sectors of the Colombian economy are led by wholesale and retail commerce, repairing of automotive vehicles and motorcycles, transportation, storage, accommodation, and food services. The second place in economic production consists of public administration, defense, social security plans, education, health care activities, and social services. The third place consists of the manufacture industry. These three groups generate the 55% of all the GDP of Colombia, approximately.

Moreover, the construction sector has occupied the fifth place in economic importance and has remained steady with an R2 of 0,92 as the measure of reliability degree or goodness of fit for the model adjusted to a data set. Likewise, it evidences a somewhat constant growth of $567,5x109 pesos per year (in average 162x106 USD). Figure 1 shows two outstanding periods. One of them occurred at the beginning of 2008 and is related to the international financial crisis named "Great Recession" and considered the deepest recession after World War II. This crisis was generated by the collapse of stock markets, the fall of housing prices, and the drastic increase in bankrupts and foreclosures; all of this conceived by the real state sector of the United States, through the use of high-risk mortgage rates, credit facilities, expansion of the assets with mortgage collaterals, among others. Subsequent to this crisis, many banks and financial institutions of the United States and foreign countries faced a considerable pressure in their financial obligations, giving place to a risk in the assets in arrears higher than usual, generating a recession in the global markets and interventions from central banks and governments all around the world (Erkens, Hung, & Matos, 2012; International Monetary Fund, 2009; Mehdian, Rezvanian, & Stoica, 2019).

The generated impact in Colombia can be seen clearly at the beginning of 2008 (Figures 1 and 2), registering an unexpected fall of the GDP (2,5%) higher than 5 points compared to the achieved GDP of 2007 (7,5%). The fall of traditionally productive sectors deteriorated the job market and the complex international panorama previously exposed (Mesa, Constanza & Aguirre, 2008). In the same way, there is an influence related to the global markets starting in 2014, when the external national income reduced in the middle of the fall of the international oil prices, affecting the Colombian economy, generating economic and political uncertainty, market volubility and reduction of the economic growth (FMI, 2018; World Bank Group, 2019a). This hardened the financial conditions and the weakening of the fiscal stimulus, impacting the manufacture industry (World Bank Group, 2019a). Likewise, the reduction of non-renewable raw material exports for the generation of energy, like carbon, and the volatility of the oil and gas markets, affect the production and generate a deceleration of the growth. Also, reduction in the investing in projects of exploration, exploitation, and production of hydrocarbons, which translates in the reduction of fiscal collection and impact on public finances and investment (Departamento de Estudios Económicos y Técnicos, 2017a; Corficolombiana, 2019b; World Bank Group, 2019a).

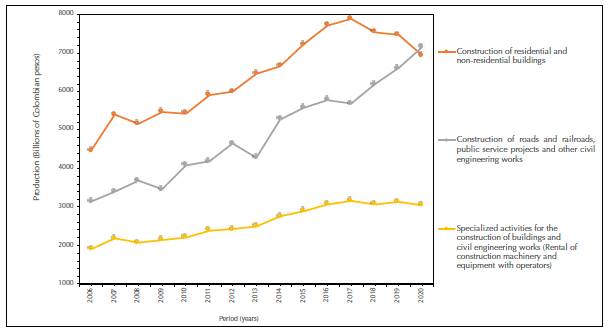

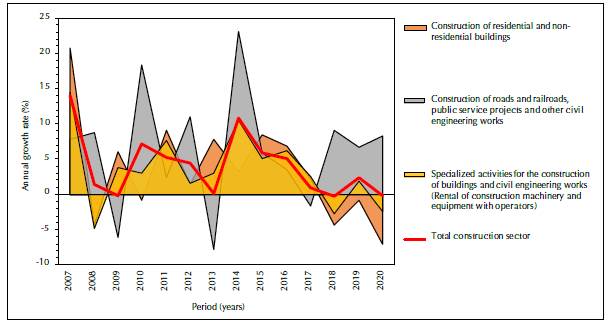

Figure 2: Production of the construction subsectors.

Construction in Colombia and its challenges

As a consequence of the macroeconomic joint previously exposed, nowadays the construction sector has experienced a change of internal policies, as well as problems in the execution or development of on-going projects. This generates a deceleration in the sector from mid-2016 and starting 2017, when the sector registered an annual contraction of -7.4%, which was the worst biannual result of this century (CAMACOL, 2019b; Departamento de Estudios Económicos y Técnicos, 2017). However, construction keeps a noticeable growth because this sector is one of the most dynamic activities of the Colombian economy and, at the same time, is fundamental for the productivity in other economic sectors. Therefore, a change in the production trend is observed in the construction subsectors, where the construction of roads and railways, public service projects, and other civil engineering construction was superior to residential and non-residential construction. In consequence, There is a trend to migrate the type of projects to formulating in agreement with the historical context, given the investing in subsectors of the economy. Figure 2 exposes the historical participation of the production of the construction subsectors.

As seen in Figure 2, the subsector of civil constructions different from buildings led the production of the sector during 2019. Conversely, the subsector of buildings (once the leader) has reduced its production steadily since 2016. As a result, the construction sector has exhibited in recent years a weak performance, although it has tried to slightly correct a descendant tendency through the investing in civil constructions since 2017, as seen in Figure 3. On the other hand, 2019 showed a fall of 1.5%, mainly explained by the decline in the 7,0% in the building subsector, which cannot be compensated by the 8,8% growth in civil constructions.

Figure 3: Annual variations of construction and its subsectors

The poorly dynamics of the building subsector since 2016 is configured as a liability of the construction growth, showing a significant deterioration starting that same year. Therefore, it is highly likely that the building subsector will continue to register annual negative variations in the present year, and the leading indicators in the sector (i.e. civil engineering projects) present a slow recovery (Corficolombiana, 2019). Thus, companies dedicated to the formulation and execution of projects need to foresee these dynamics in order to adapt and search for methodologies that help configure better opportunities in spite of the problems.

Impact of the construction sector in jobs

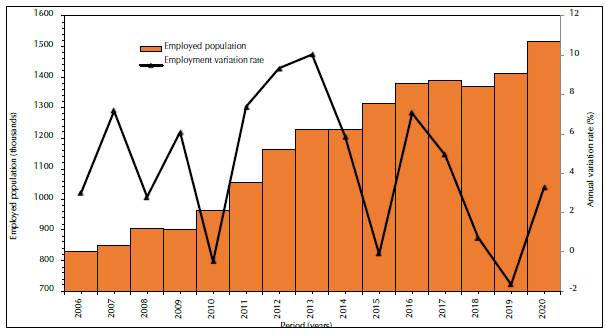

The construction sector stands out for the chaining in several sectors of the economy and generating jobs as a government policy in recession or economic deceleration times. Figure 4 shows phenomena denoting that every sector of the economy (including construction) was affected during the economic crisis of the recent years, especially during 2008, 2010, and 2016. However, the sector is a protagonist in the later generation of employment as a measure to overcome these difficulties.

Figure 4: Impact of the job generation from the construction sector

Figure 4 exposes the generation of jobs by this sector and shows a constant growth with some decelerations in the previously mentioned economic crisis; however, after these crises, job growth tends to grow. In average, the number of jobs occupied by the construction sector in 2019 was 1,514,293 workers; this is 3.2% more than what the same period of 201 8 showed. This represents a participation of 6.8% of national jobs. Additionally, the generation is mainly driven by the civil construction subsector and its growth at the beginning of 2019, and the estate aided too. This counteracted the negative results of the building subsector and increased job opportunities (CAMACOL, 2019a; Corficolombiana, 2019).

Housing Construction

The adequate performance of the building construction sector is associated to the promotion of economic and social development due to the capacity to generate jobs, demand supplies from other economic sectors, and the fact that building houses improves the life quality of the population. This conceives the building construction as a central activity in the social and economic development of the country, especially in a developing place like Colombia, where a considerable housing deficit is evident, and it allows to generate policies that include budget allocation. This allocation can be done directly or through financial institutions, and it usually activates the construction sector, creating job opportunities and an important movement of raw materials throughout the territory (Córdova & Alberto, 2018). At the same time, it considers an economic exploitation made by a natural or legal person; however, it must focus on elaborating projects that involve the urgent needs of the actors involved and later executing them (Project Management Institute, 2017).

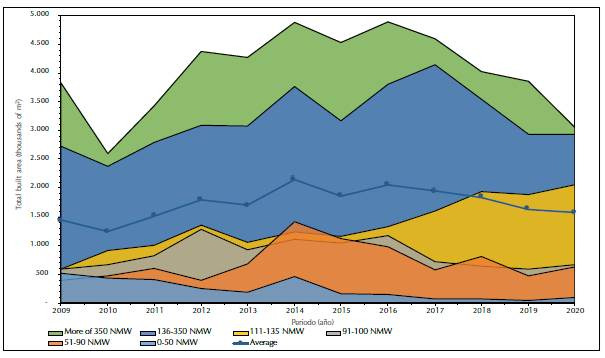

Therefore, the reduction of the built area is coherent with the decrease of the demand of housing in the country, where the non-VIS houses has reduced its participation considerably despite once dominating the market (Figure 5). Since 2016, the area of built housing with a price range higher than 350 minimum monthly salary has decreased 62%, and houses with a price range between 136 and 350 minimum monthly wage have decreased up to 73%. On the other hand, the social interest house (VIS, in Spanish) building has grown with a 55%, specifically the number of houses with a range between 111 and 135 minimum monthly wage. Likewise, the discharge of VIS of 2,055,176 m2 has meant a higher national growth in the last ten years. Nonetheless, VIS houses with a range between 91 and 110 minimum monthly wage have reached a reduction of 50%, like the priority interest houses (VIP, in Spanish), according to Law 1955 (Congreso de la República de Colombia, 2019), under 90 minimum monthly wage have reduced its participation in the market from 32% to 48%. Consequently, it is pertinent to have a housing approach according to the demand, which allows facilitating the productivity of the companies without drastically affecting their income from the formulation and execution of projects.

Figure 5: Demand of built housing area, discriminated by price range (NMW=National Minimum Wage).

According to Figure 5, the deceleration originated by the macroeconomic events aforementioned manifests later in the sector because there might be previously assigned investments starting or in process. In consequence, the reduction of the housing demand is observed in the years of crisis, differentiating the impact in diverse price ranges, especially on VIS houses. Likewise, low-income housing is mainly found in a specific housing range, which corresponds to market trends because this type of housing has better quality materials and construction processes. They also have higher real state value and appraisal, so the formulation of projects is focused on this kind of houses; actually, part of this expenses is promoted by the public sector (DANE, 2019a). This part of the construction sector registers a national descent of 11% marked out by the construction of houses, specifically non-VIP, which contrasts with the 12.5% growth of the civil projects. Particularly, the area that explains almost the totality of the behavior of the construction sector presented an annual reduction of 16.3% (Corficolombiana, 2019a). In summary, the Colombian economic growth rate relates positively with the public spending in human capital and physical infrastructure (Ortiz et al., 2019). In accordance with the above, the produced domestic demand has been weak, the consumer's trust has deteriorated, the mortgage interest rates are high, and several economy sectors have decelerated. All of this affects the demand for supplies, commercial activity, housing affordability, and job opportunity generated by housing construction.

CONCLUSIONS

The construction sector has may advantageous characteristics such as versatile nature, quick volubility, and susceptibility to both external economic phenomena and internal policies, especially in developing countries as Colombia. This can be observed with the historical analysis, which shows the economic dynamics of the country under current circumstances, particularly those of the construction sector. This analysis allows a certain perspective on the phenomena of immersion and the approach proposed in terms of social and business development.

Thanks to this research, the momentum of the construction sector for the Colombian economy is manifested, through investment in housing and civil constructions; this allows demand to rise, other sectors of the economy become more dynamic, and job opportunities are generated due to public investment and private participation. Therefore, it is important to take into account the historical context when observing the phenomena presented, so that the tools that allow the formulation of pertinent projects are available; also, it is necessary to consider the external and internal economic effects and the behavior of construction sector.

Although the housing subsector has behaved negatively in recent years, this subsector and the civil construction subsector are essential for the development of the state's social objectives. Hence, the knowledge of the behavior of the construction market, together with the formulation of investment projects and considering the needs based on demand, allows generating a prospect with the appropriate approach.

REFERENCES

Licencia

Esta licencia permite a otros remezclar, adaptar y desarrollar su trabajo incluso con fines comerciales, siempre que le den crédito y concedan licencias para sus nuevas creaciones bajo los mismos términos. Esta licencia a menudo se compara con las licencias de software libre y de código abierto “copyleft”. Todos los trabajos nuevos basados en el tuyo tendrán la misma licencia, por lo que cualquier derivado también permitirá el uso comercial. Esta es la licencia utilizada por Wikipedia y se recomienda para materiales que se beneficiarían al incorporar contenido de Wikipedia y proyectos con licencias similares.